August is shaping up to be a turning point in the trajectory of the global electronics industry. Industry reports bolster Supplyframe’s expectation that the month will deliver a marked shift in demand levels.

Analysis Reveals August Rebound in Electronics Demand

Sep 20, 2024 12:24:31 PM / by Supplyframe

Lead times for sensors are showing tantalizing signs of bottoming out, with the share of at-volume contracted delivery lags in the minimum range of 0 to 12 weeks slipping by more than ten percentage points sequentially in Q3 to 36.6%. Although the early August earthquake in Japan caused no apparent disruptions to digital image sensor production, the event underscored the supply-chain risk posed by the country's heavy concentration of sensor manufacturing.

|

Copper-clad laminates (CCLs) can contribute to over half of PCB costs, and copper makes up most of the cost of CCLs. In Q2, CCL vendors issued price increase notices ranging from 5% to 10% to PCB makers, and an additional wave of price hikes is on the horizon. PCB manufacturers have bolstered safety stocks to minimize increased CCL costs, while customers are pulling in PCB demand to reduce the impact of material price increases. |

Despite calendar Q3 routinely being peak season for consumer electronics and other end-markets, DRAM and NAND spot prices have consistently decreased. Across all memory devices, still-lackluster consumer demand growth will present flexible pricing opportunities in the shorter term. The Commodity IQ Price Index indicates that while expanding above the baseline, pricing will increase slower into Q1 2025. NAND lags behind DRAM in most respects and is forecast to be undersupplied later in 2025, whereas DRAM will be meaningfully supply-challenged in Q1 of next year.

|

Contract lead times for switches continue to dwindle after declining for five consecutive months, with 86% of at-volume lead times at 25 weeks or less for Q3. Relay lead times are also contracting, with 69% of at-volume delivery lags at under 26 weeks versus 60% in Q2. |

|

The 7.1 magnitude earthquake that struck Japan recently caused only minor electronics production and logistics disruptions. However, the event spurred concerns over the potential impact that a larger quake could have on the global electronics supply chain. |

DRAM spot market prices stabilized in late July as Samsung’s aggressive pricing for server DRAM and enterprise SSDs helped maintain market equilibrium. DDR5 is experiencing larger price hikes than currently over-inventoried DDR4, and contract DRAM pricing is expected to increase by an average of 10% in Q3 for server and PC variants. Micron increased LPDDR5 pricing by 15% at the start of calendar Q3 on stronger shipment projections for notebook and mobile electronics. Supply chain and procurement professionals are advised to seek and secure advantages from short-term spot market pricing opportunities and oversupply situations.

Copper Supply and Pricing Still a Challenge for Connector Makers

Sep 6, 2024 1:22:18 PM / by Supplyframe

Though global copper reserves will currently meet demand, consumption continues to outpace supply. According to the International Copper Study Group (ICSG), the projected surplus of copper for 2024 will contract by 65%. Pricing, while bearish, has retreated from over $10,000 per metric ton in May on fears of short supply and as Chinese smelters cut production. Yet, on average, copper pricing was 13% year-on-year in July, prompting some connector manufacturers to pass cost increases to customers to preserve margins.

Big Power Management IC Customers May Pose Supply Risk for Smaller Ones

Sep 6, 2024 1:17:05 PM / by Supplyframe

According to in-market feedback, the recent demand uptick for power management ICs (PMICs) has prevented key supplier Monolithic Power Systems from meeting customer demand. The Commodity IQ Demand Index for power ICs rose 6.8% sequentially in July. Regarding power management ICs, lead times remain at over one and half times the Commodity IQ Lead Time Index globally, while supply-side inventories sank by over 30% month-on-month in July. Lead times for general-purpose and automotive-grade PMICs are in the 20-plus week range.

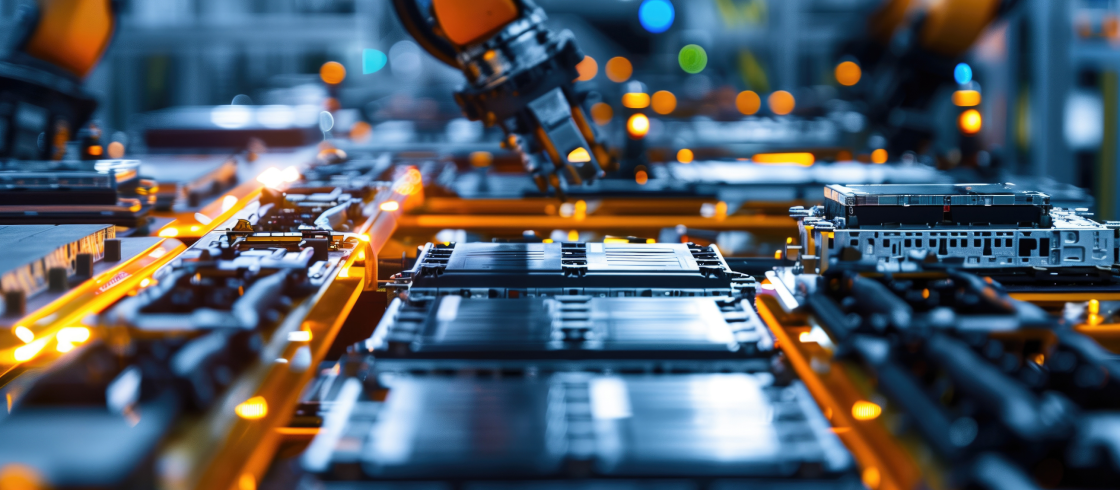

After shrinking by nearly 16% in 2023, the global PCB market is set to rebound to 6.3% growth in 2024, according to the Taiwan Industrial Technology Research Institute (ITRI). PCB lead times remain consistent, typically at 5 to 8 weeks, with some suppliers quoting an additional one to two weeks due to longer raw material lead times. China-based PCB suppliers are operating at nearly 75% production capacity, up from Q2. Lead times for copper-cladded laminate (CCL) have expanded, with standard FR-4 materials experiencing a two-week increase and special materials like high-speed and high-frequency at four weeks. Overall, the Commodity IQ At-Volume Lead Trend shows almost all Q3 contract lead times remain at 12 weeks or less.

.jpeg)